Company Sues Mike Lindell Over $1.5 Million Unpaid Loan

MyPillow founder Mike Lindell is once again facing a hefty lawsuit, this time from a merchant cash advance firm accusing him of dodging nearly $1.5 million in debt.

The plaintiff, Cobalt Funding Solutions, operates out of New York City and specializes in providing “alternative capital” to businesses by advancing loans against their future sales.

In return, they take a portion of the company’s revenues until the loan is repaid—along with a significant premium.

Lindell, however, has been openly critical of the industry, calling it a “sham.” Earlier this month, he launched his own legal attack on Cobalt, alleging the firm’s staggering 409% annual interest rate was “illegal,” “usurious,” and akin to loan sharking.

Cobalt has now fired back, filing a civil complaint last Friday in state court. According to the filing, despite halting payments, the 63-year-old Lindell has “continued to generate and collect millions of dollars in revenue” from the sale of products like pillows and bedding accessories as recently as October 18, 2024.

When reached by phone on Monday, Lindell told The Independent he wasn’t aware that Cobalt had countersued and hadn’t yet seen any of the court documents.

He vaguely suggested that Cobalt had faced issues in the past regarding its business practices, saying, “They’ve gotten in trouble before, and there’s been a lot of stuff going around about that,” but admitted, “I don’t know what it all involves.”

Regarding Cobalt’s lawsuit against him and MyPillow, Lindell said, “I’m not trying to get ahead of this. The lawyers are handling it. Right now, my priority isn’t the lawsuit—it’s running my companies and working to eliminate electronic voting machines. That’s where my focus is.”

In an email on Monday, Christopher Murray, the attorney representing Cobalt in court, declined to comment on the case, citing firm policy.

Merchant cash advances, also called “factoring” arrangements, are not subject to usury laws.

The ugly dispute between Lindell and Cobalt dates back to September 16, when Cobalt paid Lindell about $1.5 million for $2.2 million in expected MyPillow receipts, according to the complaint.

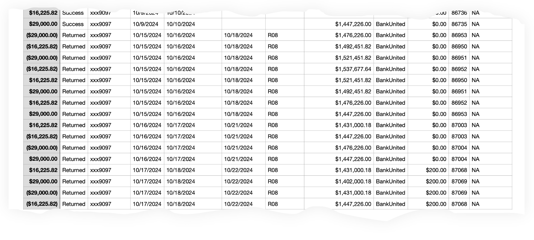

From that point forward, Cobalt began withdrawing $45,000 from MyPillow’s bank account each business day, representing approximately 7.57% of its daily earnings, according to a spreadsheet included with the complaint.

Records show Lindell consistently made payments through mid-October, totaling $814,064.76. However, the complaint alleges that Lindell abruptly stopped Cobalt’s access to the account, blocking further withdrawals of the remaining $1,447,226 owed under the agreement, along with $200 in bank fees for blocked payments.

Since then, Lindell, who personally guaranteed the loan and is legally responsible for it, has allegedly refused to resume the payments, the complaint states.

After launching a personal crusade to “prove” that the 2020 presidential election was stolen from Donald Trump, Mike Lindell faced a cascade of financial and legal troubles. Big box retailers dropped his MyPillow products, leaving the company cash-strapped and forcing it out of its Minnesota warehouse due to unpaid rent.

Lindell’s attorneys quit over millions in unpaid legal fees, and a judge ordered him to pay $5 million to a computer programmer who debunked his voter fraud claims. He also continues to fight defamation lawsuits filed by major voting machine companies over his false allegations.

In September, a California vendor sued Lindell, alleging he ignored bills totaling mid-six figures.

The following month, Lindell faced a similar issue with another cash advance company, Lifetime Funding, which claimed he owed $600,000 in receivables. In response, Lindell sued Lifetime, accusing the company of imposing an exorbitant 441% interest rate.

At the time, Lindell told The Independent, “We’re going after them. It’s all very illegal. There’s up to 1,000 percent interest—it breaks all kinds of laws.”

I am impressed with this site, real I am a fan.

Helpful information. Fortunate me I discovered your site by chance, and I am shocked why this twist of fate did not came about in advance! I bookmarked it.

An attention-grabbing discussion is price comment. I feel that you should write more on this matter, it may not be a taboo subject however usually individuals are not sufficient to speak on such topics. To the next. Cheers

Having read this I thought it was very informative. I appreciate you taking the time and effort to put this article together. I once again find myself spending way to much time both reading and commenting. But so what, it was still worth it!

It’s perfect time to make some plans for the future and it is time to be happy. I have read this post and if I could I desire to suggest you some interesting things or suggestions. Perhaps you could write next articles referring to this article. I wish to read even more things about it!

At Clockwise Antique Clocks, our unrivalled reputation is built on over 35 years of masterful horology, where every repair and restoration is carried out with the same care, authenticity, and craftsmanship the original maker intended, trusted by clients ranging from aristocracy and royalty to film, sport, and everyday collectors alike.

Im not sure the place you are getting your information, but good topic. I needs to spend some time learning much more or working out more. Thank you for magnificent info I used to be in search of this info for my mission.

This is a topic close to my heart cheers, where are your contact details though?

Excellent web site. Lots of useful info here. I’m sending it to a few buddies ans additionally sharing in delicious. And certainly, thank you to your sweat!

You should take part in a contest for one of the best blogs on the web. I will recommend this site!

I’m not sure exactly why but this weblog is loading incredibly slow for me. Is anyone else having this problem or is it a problem on my end? I’ll check back later on and see if the problem still exists.

Hello! I just would like to give a huge thumbs up for the great info you have here on this post. I will be coming back to your blog for more soon.

This blog is definitely rather handy since I’m at the moment creating an internet floral website – although I am only starting out therefore it’s really fairly small, nothing like this site. Can link to a few of the posts here as they are quite. Thanks much. Zoey Olsen

Pretty component of content. I simply stumbled upon your weblog and in accession capital to say that I acquire in fact loved account your weblog posts. Any way I will be subscribing in your augment or even I achievement you get right of entry to constantly rapidly.

I think other website proprietors should take this website as an model, very clean and great user genial style and design, let alone the content. You are an expert in this topic!

excellent points altogether, you just gained a logo new reader. What could you suggest in regards to your put up that you just made a few days ago? Any positive?

What i don’t understood is actually how you’re now not actually a lot more neatly-preferred than you may be now. You’re very intelligent. You recognize therefore considerably in the case of this matter, made me for my part believe it from numerous various angles. Its like women and men don’t seem to be fascinated except it’s one thing to do with Woman gaga! Your individual stuffs outstanding. At all times maintain it up!

I like this weblog very much so much wonderful information.

You really make it appear so easy along with your presentation however I in finding this matter to be actually one thing that I think I’d never understand. It kind of feels too complicated and extremely huge for me. I am taking a look forward in your next post, I will try to get the hold of it!

Pixel Prometheus have built websites for businesses across Gloucester with added services like SEO, photography, and videography.I look forward to collaborating with you to create a website that not only reflects your brand with clarity and professionalism but also gives you a fighting chance to succeed in a competitive digital space. http://www.pixelprometheus.co.uk

Heya i am for the primary time here. I came across this board and I find It really useful & it helped me out a lot. I am hoping to offer one thing again and help others such as you aided me.

Great work! This is the type of information that should be shared around the web. Shame on Google for not positioning this post higher! Come on over and visit my web site . Thanks =)

It’s a shame you don’t have a donate button! I’d definitely donate to this fantastic blog! I suppose for now i’ll settle for book-marking and adding your RSS feed to my Google account. I look forward to brand new updates and will talk about this blog with my Facebook group. Chat soon!

Those are yours alright! . We at least need to get these people stealing images to start blogging! They probably just did a image search and grabbed them. They look good though!

Thanks for any other wonderful article. Where else may just anyone get that type of information in such a perfect approach of writing? I’ve a presentation next week, and I’m on the search for such information.

Needed to compose you a very small word to be able to thank you so much over again for all the pleasant techniques you’ve contributed here. It has been really incredibly generous of people like you to grant publicly precisely what many of us could have offered for sale for an electronic book to earn some dough on their own, most notably given that you might have done it in the event you wanted. Those strategies additionally served to be the good way to realize that someone else have the same interest similar to mine to realize way more on the subject of this matter. I believe there are thousands of more pleasant sessions up front for folks who read through your blog post.

Sweet blog! I found it while searching on Yahoo News. Do you have any suggestions on how to get listed in Yahoo News? I’ve been trying for a while but I never seem to get there! Thanks

Thank you for sharing with us, I conceive this website really stands out : D.

Aw, this was a very nice post. In idea I would like to put in writing like this moreover – taking time and actual effort to make a very good article… however what can I say… I procrastinate alot and in no way seem to get something done.

Thank you for sharing with us, I think this website really stands out : D.

You actually make it seem so easy with your presentation but I find this matter to be really something that I think I would never understand. It seems too complicated and very broad for me. I’m looking forward for your next post, I’ll try to get the hang of it!

Howdy are using WordPress for your blog platform? I’m new to the blog world but I’m trying to get started and create my own. Do you require any coding expertise to make your own blog? Any help would be really appreciated!

Good day! This is my first visit to your blog! We are a collection of volunteers and starting a new project in a community in the same niche. Your blog provided us useful information to work on. You have done a wonderful job!

I love it when people come together and share opinions, great blog, keep it up.

I truly appreciate this post. I have been looking everywhere for this! Thank goodness I found it on Bing. You have made my day! Thank you again

I have recently started a blog, the info you offer on this web site has helped me greatly. Thank you for all of your time & work.

Thank you so much for giving everyone an extraordinarily breathtaking opportunity to read articles and blog posts from this site. It really is very pleasing and also jam-packed with fun for me personally and my office acquaintances to search your site at least thrice every week to learn the latest things you will have. And of course, I’m just at all times pleased for the beautiful principles you give. Some 1 ideas in this article are undeniably the most suitable we have all ever had.

Great write-up, I’m normal visitor of one’s web site, maintain up the nice operate, and It is going to be a regular visitor for a lengthy time.

This actually answered my problem, thanks!

I am impressed with this web site, rattling I am a fan.

Hi this is somewhat of off topic but I was wanting to know if blogs use WYSIWYG editors or if you have to manually code with HTML. I’m starting a blog soon but have no coding know-how so I wanted to get guidance from someone with experience. Any help would be enormously appreciated!

As I website possessor I believe the content material here is rattling fantastic , appreciate it for your efforts. You should keep it up forever! Good Luck.

Someone essentially help to make seriously posts I would state. This is the first time I frequented your website page and thus far? I amazed with the research you made to make this particular publish extraordinary. Wonderful job!

Incredible! This blog looks exactly like my old one! It’s on a completely different topic but it has pretty much the same layout and design. Great choice of colors!

Good write-up, I’m regular visitor of one’s website, maintain up the excellent operate, and It is going to be a regular visitor for a lengthy time.

Some truly superb posts on this site, thanks for contribution. “He that falls in love with himself will have no rivals.” by Benjamin Franklin.

Heya i’m for the first time here. I found this board and I find It truly useful & it helped me out much. I hope to give something back and aid others like you aided me.

Hi my loved one! I wish to say that this article is awesome, great written and include approximately all significant infos. I?¦d like to see extra posts like this .

of course like your web-site however you have to test the spelling on several of your posts. Many of them are rife with spelling problems and I in finding it very bothersome to inform the reality nevertheless I?¦ll definitely come back again.

Thank you for sharing excellent informations. Your website is very cool. I am impressed by the details that you have on this site. It reveals how nicely you perceive this subject. Bookmarked this web page, will come back for more articles. You, my friend, ROCK! I found simply the info I already searched everywhere and simply couldn’t come across. What a perfect web-site.

I believe this web site contains very superb pent subject material blog posts.

Normally I do not read article on blogs, but I would like to say that this write-up very forced me to try and do it! Your writing style has been amazed me. Thanks, very nice post.

NagaEmpire adalah sebuah situs slot online dengan minimal deposit 10k, situs resmi dan terpercaya di Indonesia ( NagaEmpire/Naga Empire is a online gambling platform with minimum deposit 10K IDR )

I’m Luke Sutton, a web design and creative media specialist based in Gloucester, and I work with businesses and individuals across the UK. I don’t just provide a service; I become a trusted creative partner, offering photography, video, and web design tailored to deliver results.

I like the valuable info you provide in your articles. I will bookmark your weblog and check again here frequently. I’m quite sure I’ll learn many new stuff right here! Good luck for the next!

you have a great blog here! would you like to make some invite posts on my blog?

An interesting discussion is worth comment. I feel that you need to write more on this matter, it may not be a taboo topic however usually persons are not sufficient to talk on such topics. To the next. Cheers