INTRO:

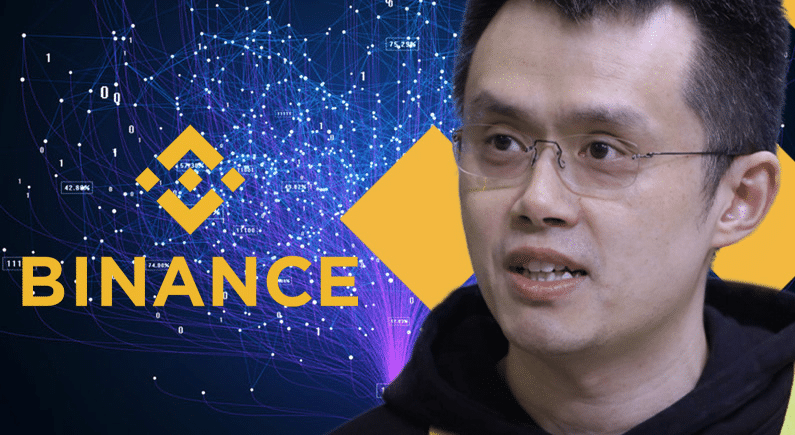

In the thrilling world of cryptocurrency, Binance has emerged as a driving force, revolutionizing the way people trade and invest in digital assets. Over the past decade, this exchange platform has left an indelible mark on the financial landscape of the crypto industry. With its credibility firmly established, Binance has achieved remarkable milestones, contributing to the growth and adoption of cryptocurrencies worldwide.

In this article, we delve into the great financial impact that Binance has had on the crypto world. We explore how Binance’s market-leading trading volume, global expansion, launchpad for innovative projects, success with its native token BNB, and comprehensive financial services ecosystem have shaped the industry. Furthermore, we also shed light on the potential concerns and challenges that Binance may face in the future if not properly addressed.

Join us on this journey as we uncover the significant contributions of Binance, examine its accomplishments over the past decade, and examine the potential obstacles that lie ahead. From its humble beginnings to its current position as a global powerhouse, Binance’s story serves as a testament to the transformative power of cryptocurrencies and the evolving nature of the financial world.

Section 1: The Great Financial Impact of Binance in the Crypto World

Over the past decade, Binance has emerged as a powerhouse in the world of cryptocurrency. With its robust platform and innovative services, the company has made a significant financial impact on the crypto industry. Here are five major ways Binance has influenced the financial landscape:

1. Market-leading Trading Volume:

Binance has consistently boasted one of the highest trading volumes in the crypto world. Its user-friendly interface, extensive range of supported cryptocurrencies, and competitive fee structure have attracted millions of traders worldwide. This high trading volume has not only boosted liquidity but has also increased price stability and market efficiency.

2. Global Expansion:

Binance’s aggressive expansion strategy has established its presence in various countries across the globe. By establishing local exchanges and partnerships, Binance has successfully tapped into new markets, facilitating increased adoption of cryptocurrencies. Its global footprint has not only driven financial growth but has also played a significant role in spreading awareness and education about blockchain technology.

3. Launchpad for Innovative Projects:

Binance Launchpad, the company’s token launch platform, has become a go-to platform for blockchain startups. By providing a trusted and reliable launchpad, Binance has enabled promising projects to raise substantial funds from a global investor base. This has not only fueled innovation but has also given retail investors access to potentially lucrative investment opportunities.

4. BNB Token Success:

Binance’s native cryptocurrency, Binance Coin (BNB), has experienced remarkable success. Initially launched as a utility token for trading fee discounts, BNB has evolved into a multi-faceted asset. Binance’s commitment to burning a portion of BNB tokens from its profits has created scarcity and driven its value upward. BNB’s success has had a positive impact on the overall market sentiment and has provided additional avenues for investors to participate in the crypto ecosystem.

5. Financial Services Ecosystem:

Binance has built a comprehensive financial services ecosystem, providing users with a wide range of offerings beyond trading. These include Binance Earn for staking and yield farming, Binance Loans for borrowing and lending, Binance Visa Card for crypto payments, and Binance Launchpool for earning rewards through token staking. This diverse ecosystem has not only generated substantial revenue for Binance but has also empowered users to maximize their crypto holdings.

Section 2: Potential Future Concerns with Binance if Not Properly Addressed

While Binance has enjoyed tremendous success, there are potential concerns that could impact its future trajectory if not adequately addressed. Here are three key areas of concern:

1. Regulatory Challenges:

As the regulatory landscape surrounding cryptocurrencies evolves, Binance faces increasing scrutiny from regulatory bodies worldwide. A lack of clarity or failure to comply with regulations could lead to legal challenges, operational restrictions, or reputational damage. Binance must continue to work proactively with regulators, enhance compliance measures, and adapt to changing regulatory requirements to maintain its credibility.

2. Security Breaches:

The crypto industry is no stranger to security breaches, and Binance has not been immune to them. While Binance has taken steps to enhance its security infrastructure, the evolving nature of cyber threats poses an ongoing risk. To mitigate this risk, Binance must continue investing in robust security measures, conducting regular audits, and educating users about best practices for securing their accounts.

3. Market Competition:

The crypto industry is highly competitive, with numerous exchanges vying for market share. Newer exchanges with innovative features and lower fees can pose a challenge to Binance’s dominance. To stay ahead, Binance must continue to innovate, enhance its user experience, and offer competitive services. Building strong partnerships and expanding into emerging markets will also be crucial for maintaining its competitive edge.

CONCL:

Binance’s financial impact on the crypto world over the past decade cannot be overstated. Its market-leading trading volume, global expansion, launchpad for innovative projects, success with BNB, and comprehensive financial services ecosystem have propelled the company to the forefront of the industry. However, potential future challenges, including regulatory hurdles, security breaches, and market competition, require careful attention and proactive measures from Binance to ensure its continued success and credibility in the ever-evolving crypto landscape.

Hello! I could have sworn I’ve been to this blog before but after browsing through some of the post I realized it’s new to me. Anyways, I’m definitely happy I found it and I’ll be book-marking and checking back frequently!